Institutional Market Intelligence Mapping Note on 27302711, 253832525, 692103328, 661405440, 931036269, 196531151

The Institutional Market Intelligence Mapping Note presents a detailed examination of identifiers 27302711, 253832525, 692103328, 661405440, 931036269, and 196531151. Each identifier plays a critical role in guiding market participants through the intricacies of institutional investments. By analyzing these identifiers, stakeholders can uncover significant trends and assess potential risks. However, the shifting landscape of the market raises questions about the implications of these dynamics for future investment strategies.

Overview of Identifiers and Their Significance

Identifiers play a crucial role in the institutional market, serving as essential tools for distinguishing and categorizing entities within various sectors.

Their significance lies in enhancing market analysis by providing a structured framework for identifying relationships and assessing performance.

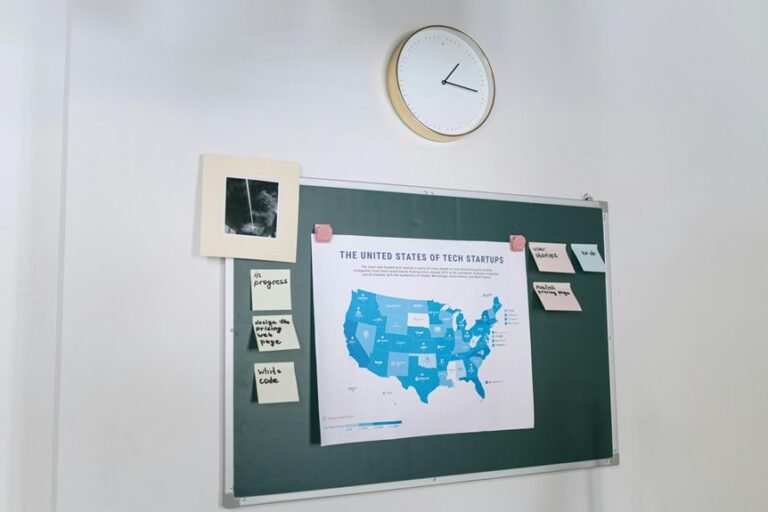

Key Trends and Patterns in Institutional Market Dynamics

As the institutional market continues to evolve, several key trends and patterns have emerged that significantly impact its dynamics.

Market segmentation has intensified, driven by behavioral trends and economic indicators.

Competitive analysis reveals shifting investment strategies, necessitating robust risk assessments.

Regulatory changes demand agility, while technology adoption reshapes operational frameworks, highlighting the importance of adaptability in this complex landscape.

Emerging Opportunities and Challenges

The evolving landscape of the institutional market presents a duality of emerging opportunities and challenges that stakeholders must navigate.

Investment strategies must adapt to address market volatility and emerging risks, while regulatory changes introduce complexities that require careful consideration.

Stakeholders who can effectively balance these dynamics may harness potential growth, yet they must remain vigilant against the pitfalls inherent in this shifting environment.

Implications for Investors and Market Participants

Significant implications arise for investors and market participants as they navigate the complexities of the institutional market.

Investment strategies must adapt to heightened market volatility and evolving institutional behavior. Effective risk assessment is essential for optimizing asset allocation amidst regulatory changes.

Understanding these dynamics enables informed decisions, allowing investors to capitalize on opportunities while mitigating potential risks inherent in the current landscape.

Conclusion

In conclusion, the institutional market intelligence mapping note reveals that structured identifiers play a crucial role in navigating market complexities. While some may argue that reliance on such tools risks oversimplification, the reality is that these identifiers empower stakeholders to make informed decisions amid uncertainty. By embracing these analytical frameworks, investors can better understand evolving trends, ultimately fostering resilience and adaptability in an ever-changing financial landscape, thereby capitalizing on growth opportunities while effectively managing risks.